It’s not all doom and gloom after all? The Bank of England is expected to raise interest rates twice this year after the UK economy grew 0.5% in the last three months of 2017, up from 0.4% in the third quarter and stronger than expected. The Bank is expected to upgrade its growth forecasts and leave the door open to an interest rate hike in May, with a further rise expected in November.

The EY Item Club group, employing the Treasury’s own economic forecasting models, has upgraded its prediction for 2018 GDP growth from 1.4% to 1.7%, adding that the economy is “over the worst”. However, it’s still too early to crack open the champagne – Britain remains confined to the “middle lane” relative to its EU and global peers, with expected GDP growth of only 1.7% in 2019 and 1.9% in 2020.

The path of interest rates will depend to a large extent on the outcome of Brexit negotiations, which, according to Mark Carney, will affect GDP growth as well as the strength of the pound, trade and inflation. With wage growth of 2 to 3% in the private sector, there is considerable pressure on the Bank of England to raise rates from current “emergency” levels.

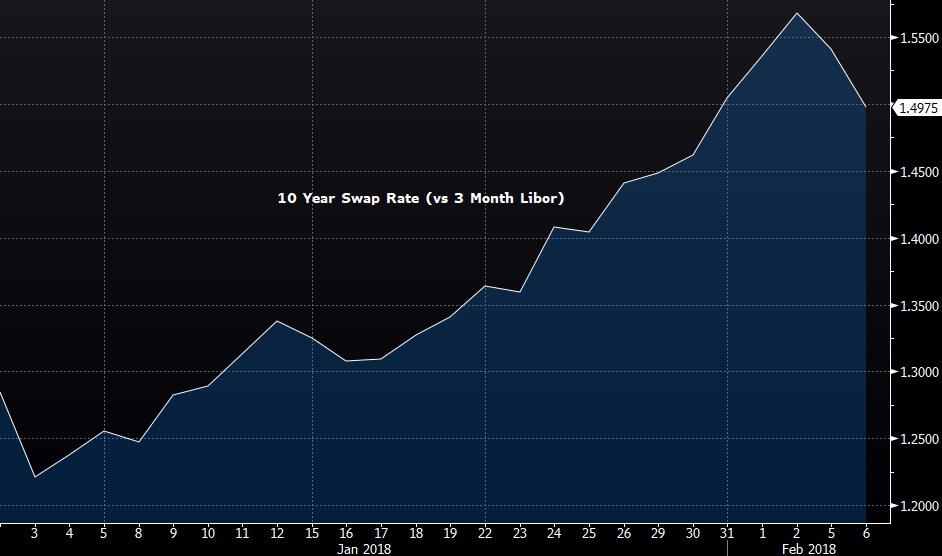

Since the start of 2018, the five and ten-year swap rates has increased sharply by 26 and 28 basis points, respectively. You can keep track of key market rates by subscribing to our FREE market rate sheet. Updated daily, this concise summary covers swap rates (i.e. fixed rates for loans), FX rates and more. Download our market-rate sheet here.