What is a Cap?

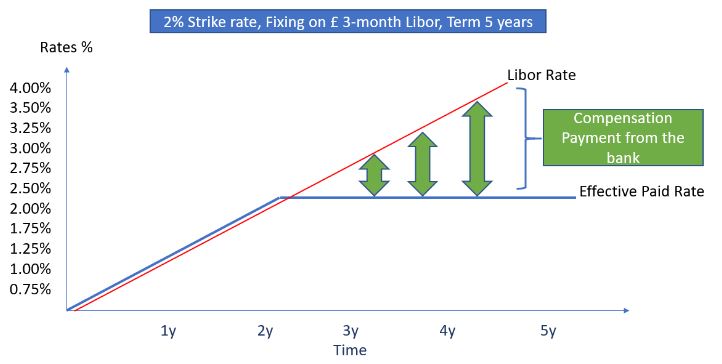

An Interest Rate Cap is a contract which allows the buyer to limit (i.e. ‘cap’) the interest cost for a given period at a specific rate. Its characteristics are similar to that of an insurance policy in that the buyer pays a premium either upfront or over an agreed period and the Cap pays out when rates are higher than the “strike rate”, see below.

Advantages

The main advantages of a Cap are it allows the buyer to hedge against adverse rate increases whilst allowing the buyer the opportunity to participate in rate reductions if interest rates fall. Also as the premium is usually paid upfront, there are no credit restrictions against the underlying asset or SPV being hedged which are applicable for example in a Swap transaction. This also allows for easier portability to another asset (or bank) if the original asset is sold and makes Caps particularly attractive for “portfolio hedges” where multiple assets or SPVs are being hedged.

Disadvantages

The main disadvantage is the premium paid (generally upfront) which is a cash cost. In addition, the level of protection will always be set higher than the prevailing floating rate (for example 3 Month LIBOR).

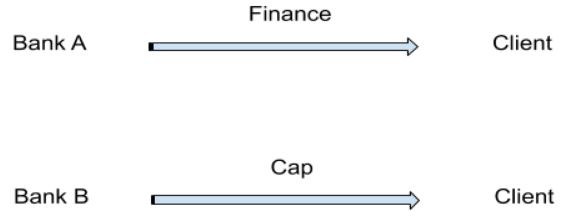

What is an independent Cap?

An independent Cap is simply a Cap purchased from a 3rd party hedge provider, and separate from the obligation the borrower has to the underlying lender.

Example

The product allows flexibility to put hedging in place with a third party where the underlying lender is unable to provide hedging. In certain circumstances, the underlying debt provider will be required to hedge but not able to provide it. Although “pay as you go” Caps are available from some hedge providers at an interest charge since the hedge provider is effectively lending the premium.

Recent Client Example

A property development company had an asset of £20m with an LTV of 55% ( loan £11m linked to 3m LIBOR at a margin of 2.50%), they wished to hedge for 5 years the interest cost to insure against higher rates, loan covenant clauses such as ICR and provide certainty in the project. The current lender was unable to provide hedging. After a series of meetings with Vedanta an appropriate hedging strategy was recommended, an interest CAP with a strike rate of 1.00% against 3m LIBOR costing £36k provided by one of our panel of independent hedge providers. The resulting hedge gave the client the certainty required at a competitive price.

Being able to advise on and source third party hedging requires speciality knowledge of which providers are best suited to provide the specific cap. We can also streamline the process and ensure that the pricing is as competitive as possible using the same derivative pricing models as the banks.