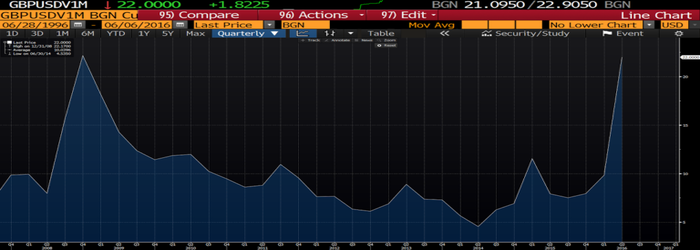

As Brexit concerns weigh on the electorate, the financial markets have taken to punishing Sterling and increasing currency volatility.

This has a real impact for SMEs due to the volatility in GBP/EUR and GBP/USD in particular. In fact, as the above chart shows, the volatility in GBP/USD was as high yesterday as the 2008 financial crash!

This has a real impact for businesses looking to hedge their FX risk, whether they are importers or exporters. Why does volatility matter? In short, volatility directly affects the price of insurance or ‘options’ to protect against currency movements.

Vedanta Hedging has seen a surge of requests from clients wanting advice and guidance on how to hedge their currency for the next 3 – 6 months.

Abhishek Sachdev of Vedanta Hedging was interviewed by Reuters:

Customer questions about taking out insurance on the value of the pound have increased four-fold in the last 6-8 weeks, according to Abhishek Sachdev, managing director of Vedanta which advises small businesses on hedging risk.

Sachdev said 10-day volatility in the sterling/euro had increased from 6 percent to 14 percent in the last two weeks, showing the impact of recent opinion polls which have highlighted that the result may be too close to call.

“This kind of volatility is making our message that companies need to consider how they hedge against such risk easier to understand, because customers are scared,” Sachdev said.

The full article can be found here: