Higher than expected inflation in the US for April caused a sell off in the global equity markets last week. American consumer prices increased at the fastest rate in over a decade, bringing with it the fear that a continued rise in prices will leave the Fed with little to no choice but to raise interest rates above the current historically low levels. The UK interest rate cycle typically follows that of the US and it wouldn’t be surprising to see the MPC raise rates following a similar decision by the Fed.

The risk of inflation in the UK economy was highlighted by the Bank of England’s chief economist, Andy Haldane, who spoke positively about the UK’s recovery and said that inflation will be above the 2% target by the end of the year. If the inflation target is missed by more than 1 percentage point either side of the target, the Bank of England must explain to the government why this is the case and how they plan to bring inflation back to 2%.

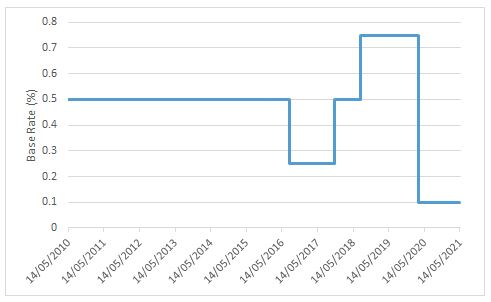

The pandemic last year caused the MPC to drop the base rate to 0.10%. With lower interest rates, the cost of borrowing including mortgage repayments becomes cheaper. Consumption will increase and savings will decrease. If the MPC increases rates, consumption decreases and savings increase; this will help reduce the growth of aggregate demand in the economy and the slower growth will then lead to lower inflation.

The pandemic last year caused the MPC to drop the base rate to 0.10%. With lower interest rates, the cost of borrowing including mortgage repayments becomes cheaper. Consumption will increase and savings will decrease. If the MPC increases rates, consumption decreases and savings increase; this will help reduce the growth of aggregate demand in the economy and the slower growth will then lead to lower inflation.

Andrew Bailey, Bank of England’s Governor, has commented that the sharp rise in the US’s inflation is certainly something to watch closely but made it clear that he does not expect inflation to rise above the 2% target this year, contradicting Andy Haldane’s comments.

It is impossible to predict when rates will rise. It was only a few months ago when the market was expecting negative rates; though this is not an impossibility, it seems significantly less likely at present. The current base rate of 0.10% is undoubtedly attractive for borrowers on a variable rate but the ultimate question of when to hedge is likely at the forefront of most borrowers’ business decisions.

We are seeing a significant increase in clients hedging with their lending banks as well as through independent third party caps. We work with a panel of independent cap providers who are able to offer both Base Rate and SONIA caps. Please click here to view our article on independent interest rate caps.

With the transition away from LIBOR well under way, we are currently also assisting several clients as they transition to SONIA or Base Rate. Your bank should have contacted you with regards to the transition by now; please feel free to get in touch with any questions you may have and find out how we are able to assist. You may find our recent website article on the Libor Transition useful (please click here).

Please get in touch with any questions you may have and a member of our team will be able to assist you.

You can reach us on 0207 183 2277 or at info@vedantahedging.com.