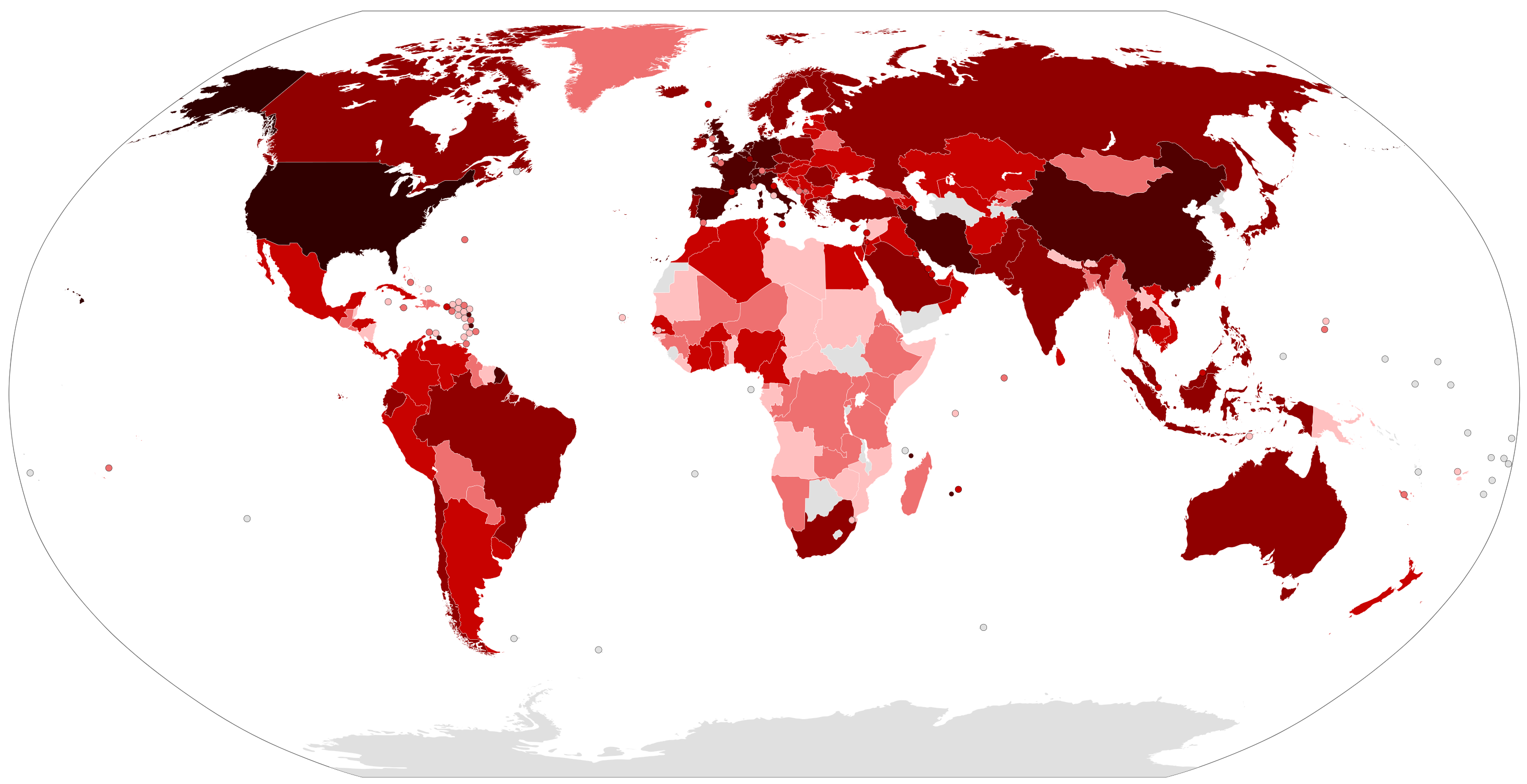

Global markets have been rocked by the ongoing coronavirus pandemic and the evolving oil price war between Saudi Arabia and Russia which saw the oil price have its largest one day decline, (-30%) since the 1990s at the start of the first Iraq war. The global bond markets followed in tandem, spiraling downwards with US government bonds (Treasuries) for the first time ever yielding less than 1% across all maturities out to 30 years, before subsequently recovering.

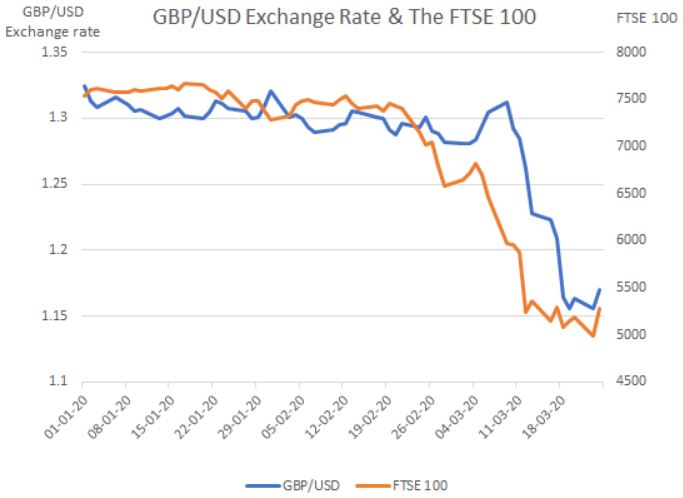

Here in the UK gilt yields tumbled initially, at one point all maturities out to 7 years yielded less than 10bps, as an example, the yield on 5-year government bonds reached a new low of 0.09bps! Similarly, global equities and in particular the FTSE 100 reached a recent low of 4,769 from a peak of 7,689 back in mid-January, representing a near 40% fall in the space of 2 months! This coupled with the fall in Sterling from a high of 1.3280 in January to a recent low of 1.1550 represents a 13% reduction, for US-based investors. UK equities were at one point over 50% cheaper than in January in dollar terms.

In response, global central banks have eased rates drastically and ejected both liquidity and targeted fiscal relief. In the US the Federal Reserve cut its funding rate to between 0 and 25bps. Similarly in Australia, the reserve bank cut its rate to 25bps, a new all-time low. Here in the UK, the Bank of England announced an emergency 50bps cut, followed by a further 15bps reduction in the Base Rate to 0.1% accompanied by an expansive budget. The dramatic increase in public spending and the subsequent fiscal and targeted support packages amount to a stimulus totaling approximately 15% of current GDP and is forecasted to have a net positive effect on GDP of around half a percent. However with the previous fiscal rules now abandoned and caution being thrown to the wind, gilt issuance to finance this package of infrastructure and investment will see supply increase substantially in the coming years with the National Debt as a percentage of GDP set to rise contrary to recent forecast of a steady decline towards balance over the medium term. The effect on medium terms rate is as yet unknown but it clearly leaves the UK government less ammunition to ramp up spending in response to further external shocks to the economy.

In response, global central banks have eased rates drastically and ejected both liquidity and targeted fiscal relief. In the US the Federal Reserve cut its funding rate to between 0 and 25bps. Similarly in Australia, the reserve bank cut its rate to 25bps, a new all-time low. Here in the UK, the Bank of England announced an emergency 50bps cut, followed by a further 15bps reduction in the Base Rate to 0.1% accompanied by an expansive budget. The dramatic increase in public spending and the subsequent fiscal and targeted support packages amount to a stimulus totaling approximately 15% of current GDP and is forecasted to have a net positive effect on GDP of around half a percent. However with the previous fiscal rules now abandoned and caution being thrown to the wind, gilt issuance to finance this package of infrastructure and investment will see supply increase substantially in the coming years with the National Debt as a percentage of GDP set to rise contrary to recent forecast of a steady decline towards balance over the medium term. The effect on medium terms rate is as yet unknown but it clearly leaves the UK government less ammunition to ramp up spending in response to further external shocks to the economy.

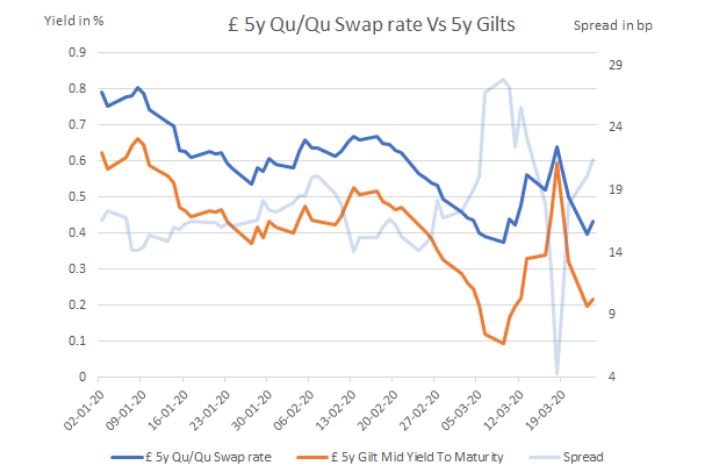

With this backdrop, the Sterling derivative market has initially tracked other asset classes lower with medium-term swap rates falling across the curve, for example, a 5-year quarterly swap recorded a new recent low of just 0.30bps. Similarly, Sterling CAP pricing initially collapsed falling by 9% compared to February and by 30% compared to August 2019 only recovering recently as bond market yields turned higher.

The Spread between the Swap rate and gilts initially fell to a recent low of 4bp, swap rates > gilt yields, this has moved back as the market comes to terms with the increased level of issuance now forecast.

The Spread between the Swap rate and gilts initially fell to a recent low of 4bp, swap rates > gilt yields, this has moved back as the market comes to terms with the increased level of issuance now forecast.

The last few weeks saw a $2trillion stimulus package agreed in the US, the largest ever in US history. The UK also introduced measures such as paying 80% of workers’ wages for the first time in the country’s history. These truly are unprecedented times and the actions in the next few weeks are crucial in determining the magnitude of the effects for the global economy.

Please do contact us if you’d like to discuss any aspect of hedging, fixed rates, or currency risk management.