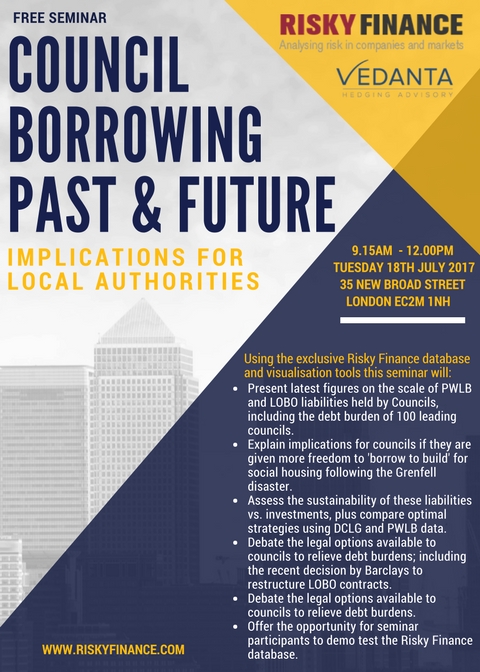

Vedanta Hedging, Risky Finance and Collyer Bristow are holding a seminar at our offices on Tuesday 18th July (09:15-12:00).

Please click here to register for free

Abhishek Sachdev of Vedanta Hedging Ltd, Nick Dunbar of Risky Finance and Janine Alexander of Collyer Bristow LLP will providing their expert advice into this complex topic.

Last week’s Queen’s Speech exacerbates existing uncertainties facing local government at a time when it desperately needs clear direction in a number of key policy areas including funding. Local government finance remains unsettled against the backdrop of a fragile economy, Brexit negotiations and a country being managed by a minority government. Councils themselves remain uncertain about how they will be funded beyond 2020, with the Local Government Association estimating that councils face a challenging overall funding gap of £5.8 billion by 2019/20.

Consequently, councils are now investing heavily in the commercial and residential property markets to plug both funding gaps and loan repayment requirements due to past borrowing decisions. Financial Times commentator John Plender describes this as ‘the council credit bubble’, and the House of Common’s Committee of Public Accounts remains concerned about the financial sustainability of local authorities citing risks ‘arising from the increasing scale and changing character of commercial activities across the sector’.

In this context, past and present council borrowing decisions remain a prominent issue as the total level of local government debt in 2015 – 16 stands at £91 billion according to latest government figures. While £64 billion represents Public Works Loan Board (PWLB) debt, £15 billion of the debt is in the form of ‘Lender Option Borrower Option’ (LOBO) loans from banks.

Expert analysis by Risky Finance and Vedanta Hedging shows the burden of legacy debt on councils, particularly those LOBO loans which represent the most expensive at a time when UK interest rates have hit all-time lows and councils are facing acute budget pressures.

For instance, the hundred biggest local authority borrowers are currently paying more than 25 per cent of their council tax revenues in annual interest to the PWLB and LOBO lenders alone. By contrast, interest payments on LOBO debt averages 7 per cent of 2015-16 council tax revenues, some £718 million, with significant variances in 49 Councils with the highest LOBO borrowing. Collectively, these councils account for some 53 per cent of the UK total exposure to LOBOs and are paying £380 million combined per annum on their LOBO debt.

In addition, trying to exit these LOBOs loans today would cost these Councils some £32 billion, more than twice their face value because of market value break clauses in the contracts. For example, Barclays Bank – one of the largest commercial lenders of LOBO loans to local authorities – announced a £1 billion ‘giveaway’ in 2016 through unilaterally waiving LOBO clauses in its £8.6 billion portfolio of loans to councils, housing associations and educational bodies. In reality, all it did was reduce the break cost of the loans by 16 per cent – meaning that affected councils are still paying excess interest costs on this debt burden.

This is happening at a time when councils are struggling under cost pressures to maintain much needed public services for their local communities. In addition, following the Grenfell disaster there are growing calls for councils to be given the freedom to borrow to build safe social housing, understanding past borrowing decisions is critical in avoiding excessive debt liabilities in the future.

Independent analysis of the scale and nature of loans taken out by local authorities is hard to come by, complex to understand and ridden with financial jargon. So independent financial analysts Risky Finance, in collaboration with corporate treasury consultants Vedanta Hedging, are pleased to announce a free seminar for all those interested in local government finance and borrowing as well as LOBOs.

Using the exclusive Risky Finance database and visualisation tools, this seminar will:

This seminar is specifically designed for policy makers, local government officers and elected representatives including:

Please click here to register

About Risky Finance

Risky Finance offers financial data visualisation and analysis tools, enabling users to make better risk management decisions. The platform allows subscribers to identify trends and patterns in extensive datasets, such as bank Basel pillar 3 disclosures, global sovereign and corporate bond markets and UK Local Authority borrowing, including a unique dataset of £8.9 billion council Lender Option Borrower Option (LOBO) loans compiled from Freedom of Information disclosures. Founded in 2016 by Nicholas Dunbar, the award-winning financial journalist and author, the site also provides expert commentary.

About Vedanta Hedging Advisory

Vedanta Hedging Advisory is the largest Financial Conduct Authority (FCA) authorised firm in the UK providing hedging advice to SMEs and large corporates across all sectors. Vedanta is currently advising some of the largest derivative disputes in the UK where claim values are in excess of £2 billion. Vedanta is regularly asked to provide expert advice and analysis on the subject of hedging for SMEs by the Government and the FCA. In 2012 the firm instigated the swaps mis-selling investigation for the FCA and has also been instrumental in exposing the mis-selling of Lender Option Borrower Option (LOBO) loans to local authorities. Vedanta was subsequently asked to give oral evidence in 2015 to the House of Common’s Communities and Local Government Select Committee about the sale of derivatives to Councils and Local Authorities and is frequently asked to provide expert comment to the media.