At such unprecedented times when ‘what if?’ has suddenly become ‘now what?’, survival is at the forefront of several businesses today. We have been contacted by several of our clients with queries regarding their loan and hedging in the past few weeks.

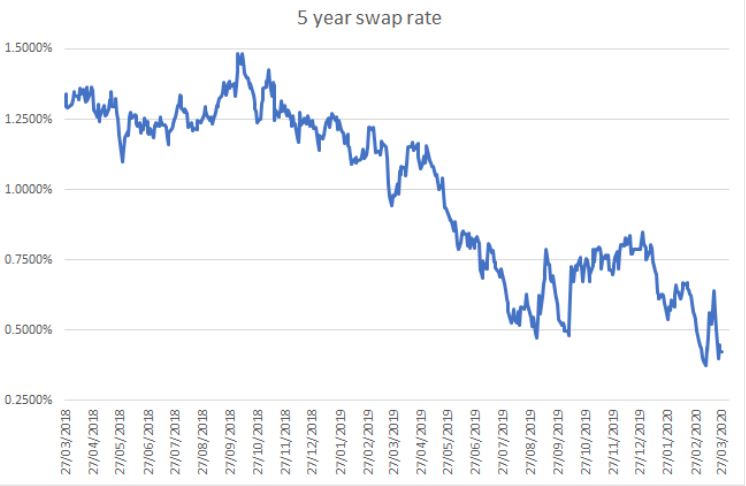

Below are the most common questions we have received and these questions are undoubtedly the correct ones to be asking at a time like this when UK Base Rate is at 0.10% and the 5 and 3 year swap rates of 0.39% and 0.36% respectively are below the 3-month GBP LIBOR of 0.67%.

Is it worthwhile for me to switch from 3-month LIBOR to 1-month LIBOR?

Is it worthwhile for me to switch from 3-month LIBOR to 1-month LIBOR?

You may be considering switching from paying quarterly 3-month LIBOR interest payments to monthly 1-month LIBOR payments to possibly take advantage of 1-month LIBOR being lower than 3-month LIBOR. It is important to note that any calculations which are made can only be based on forward rates which are constantly changing. If you do decide to make the switch, it is important that the same change be made to your hedging product. We are able to assist with modelling the above for your loan and hedging product in order to help you make a decision. Again, we have had discussions with both relationship teams and hedging teams (that both have different drivers) to obtain a suitable outcome.

If I take an interest payment holiday on my loan, what will happen to my hedging product?

Your hedging product profile should match your loan’s profile. Therefore if you are taking an interest payment holiday on your loan, the same should be applied to your hedging product. The process of implementing this may differ across banks and we would be happy to liaise with the relevant contacts at your bank to assist with the process. There can be a need for important but sensitive discussions with both parts of the bank (the relationship team and the hedging team) to obtain a favourable outcome.

What happens if interest rates fall below 0%?

It is likely that your loan agreement will have a clause specifying that, in the case where interest rates fall below 0%, the interest rate will be taken as 0%. In other words, the bank will not pay you interest in the scenario where interest rates are negative. If you do have an interest rate swap but do not have an interest rate floor (for the swap), there could be a scenario where you are making both the fixed and floating interest payments on the swap (if rates fell below 0%). It may still be possible to purchase a ‘zero-percent floor’. Contact us to discuss and also see here our previous post on this topic

My interest rate hedging product is currently a cap. Does the above question regarding negative rates apply to me?

Since a cap can only work in your favour (i.e it is effective if interest rates increase above your cap strike rate), negative rates are irrelevant in relation to the interest rate cap. The premium which you paid for the cap is the maximum cost for your hedge.

Is there any value in my existing cap?

There could be a positive value (also called mark-to-market) for your cap but we would need to review the trade details to check this. If there is positive value left for your cap and you would like to close the trade, we would be able to liaise with your bank to assist. A point to consider is that most banks will charge a fee (trader’s charge) to close a trade; which we will of course do our best to negotiate to minimum levels.

Please feel free to contact us if you have any questions regarding the above or any additional queries you may have about your debt and hedging.